Are you and your partner struggling with differing financial habits? If so, you’re not alone. Many couples find themselves facing this challenge, and it can be a source of tension and conflict in a relationship. But fear not, for there is a solution. Introducing “How Do I Approach My Partner About Our Differences In Financial Habits?” This insightful product provides practical advice and strategies to help you navigate this sensitive topic with ease and understanding. With the guidance and support offered, you can finally address your differences in financial habits and work towards a harmonious financial future together.

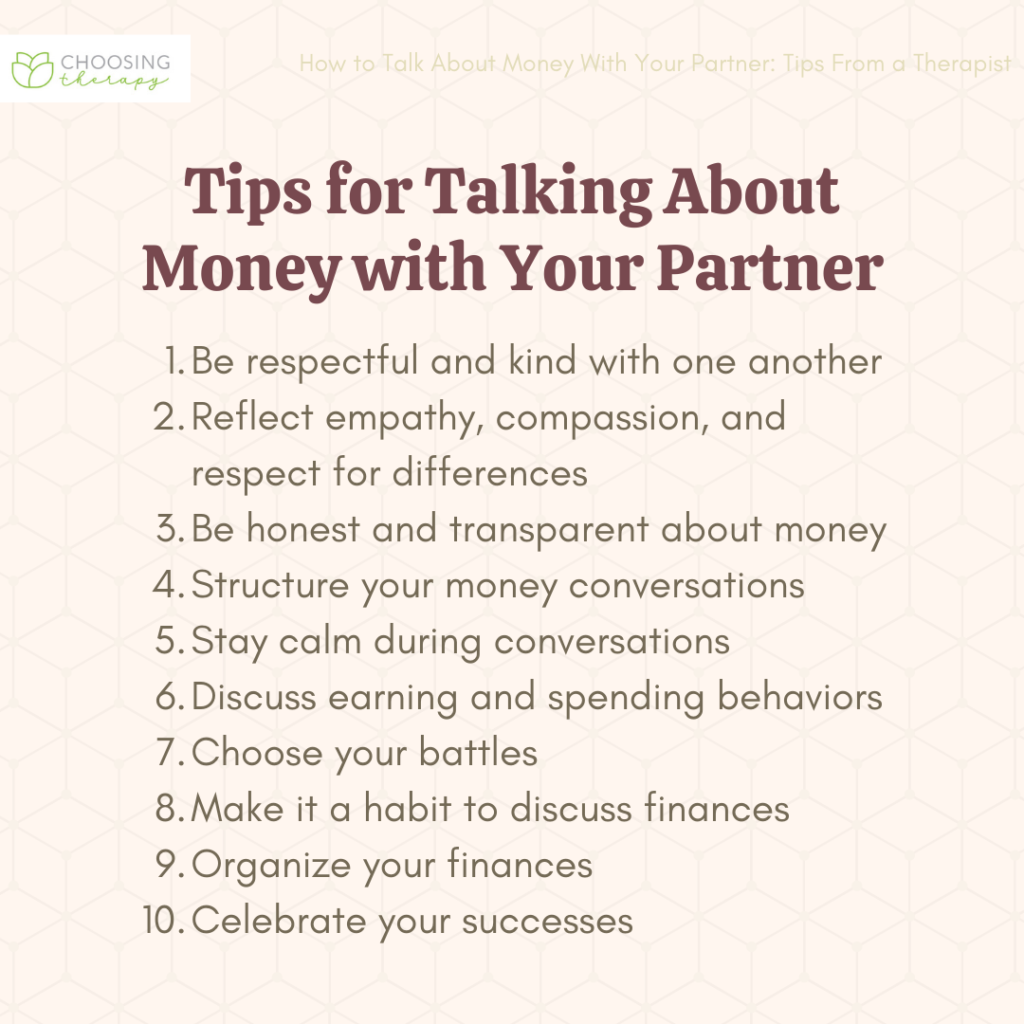

This image is property of www.choosingtherapy.com.

Understanding and Reflecting on Your Own Financial Habits

Assessing your own financial habits

Before delving into discussions about your partner’s financial habits, it’s important to start by reflecting on your own. Look at your spending patterns, saving habits, and overall approach to money management. Assessing your own financial habits will give you a better understanding of where you stand and help you approach conversations with your partner from a place of self-awareness.

Identifying your values and priorities

Take a moment to reflect on your values and priorities when it comes to finances. What do you consider important? Is it saving for the future, investing in experiences, or being debt-free? Understanding your own financial values will allow you to communicate them effectively to your partner and find points of convergence or compromise.

Recognizing areas of improvement

No one is perfect when it comes to finances, and it’s important to recognize areas where you may need improvement. Are you prone to impulse buying? Do you struggle with sticking to a budget? Identifying these areas of improvement will not only help you in your own personal growth but also open up conversations with your partner about ways to collectively work on improving your financial habits.

Understanding Your Partner’s Financial Habits

Observing and analyzing their spending patterns

Take note of your partner’s spending habits. Observe how they prioritize and allocate their funds. Do they prefer investing in long-term goals or indulging in immediate gratification? Understanding their spending patterns will provide valuable insights into their financial mindset and allow for meaningful conversations about money.

Discussions and openness about finances

Open and honest conversations about finances are essential in any relationship. Make an effort to discuss each other’s financial goals, concerns, and dreams. Creating a safe space where you both feel comfortable sharing your financial situation will promote transparency and help in understanding each other’s financial habits better.

Understanding their values and priorities

Just as you identified your own values and priorities, it’s equally important to understand your partner’s. Take the time to listen and engage in meaningful conversations to gain insights into their financial values and what matters most to them. Understanding their values will foster empathy and allow you to approach any differences with sensitivity.

Identifying Points of Convergence and Divergence

Identifying common financial goals and interests

Explore areas where your financial goals and interests align. Are both of you seeking financial stability or early retirement? Identifying common goals will help you establish a shared vision for the future and find ways to support each other in achieving those goals.

Recognizing and acknowledging differences

No two individuals will have identical financial habits, and that’s okay. It’s crucial to recognize and acknowledge the differences in your financial approaches. Understand that these differences may stem from different upbringings or personal experiences. By acknowledging these disparities, you can approach conversations with a better understanding and willingness to find common ground.

Exploring consequences and effects of financial disparities

Take the time to discuss the consequences and potential effects of any financial disparities between you and your partner. This could include differing spending habits, saving priorities, or attitudes towards debt. Understanding the impact of these differences will help you both navigate towards finding a balanced and harmonious approach to managing your finances.

Creating a Safe and Open Environment

Establishing effective communication

Communication is key when considering any topic, including finances. Establish open and non-judgmental communication channels with your partner. Encourage active listening and ensure that both of you have equal opportunities to express your thoughts and fears about money.

Setting aside dedicated time for discussions

Make it a point to set aside dedicated time to discuss your finances. By prioritizing these conversations, you demonstrate a commitment to understanding each other and finding mutually beneficial solutions. This dedicated time allows both partners to fully engage and contribute to the discussion, fostering a sense of partnership in financial decision-making.

Encouraging both partners to share their perspectives

Encourage your partner to openly share their thoughts, concerns, and aspirations about money. Actively listen and validate their feelings to create a safe environment where both partners feel comfortable expressing their perspectives. Remember that true understanding comes from a willingness to hear and consider each other’s viewpoints.

This image is property of media.npr.org.

Approaching the Conversation with Sensitivity

Avoiding blame and criticism

When discussing differences in financial habits, it’s important to avoid blame or criticism. Instead of accusing your partner or making them feel guilty, focus on understanding their perspective and finding solutions together. Approach the conversation with empathy and a genuine desire to work as a team.

Using ‘I’ statements to express concerns

Express your concerns using “I” statements to avoid sounding accusatory. For example, say “I feel anxious when I see large credit card bills” instead of “You spend too much and put us in debt.” By using ‘I’ statements, you express your feelings without placing blame on your partner, fostering a more open and constructive conversation.

Demonstrating empathy and understanding

Approach the conversation with empathy and understanding for your partner’s financial habits. Recognize that everyone has their own financial journey and may have different perspectives shaped by their upbringing and experiences. By demonstrating empathy, you create a safe space for both partners to open up and work towards finding common ground.

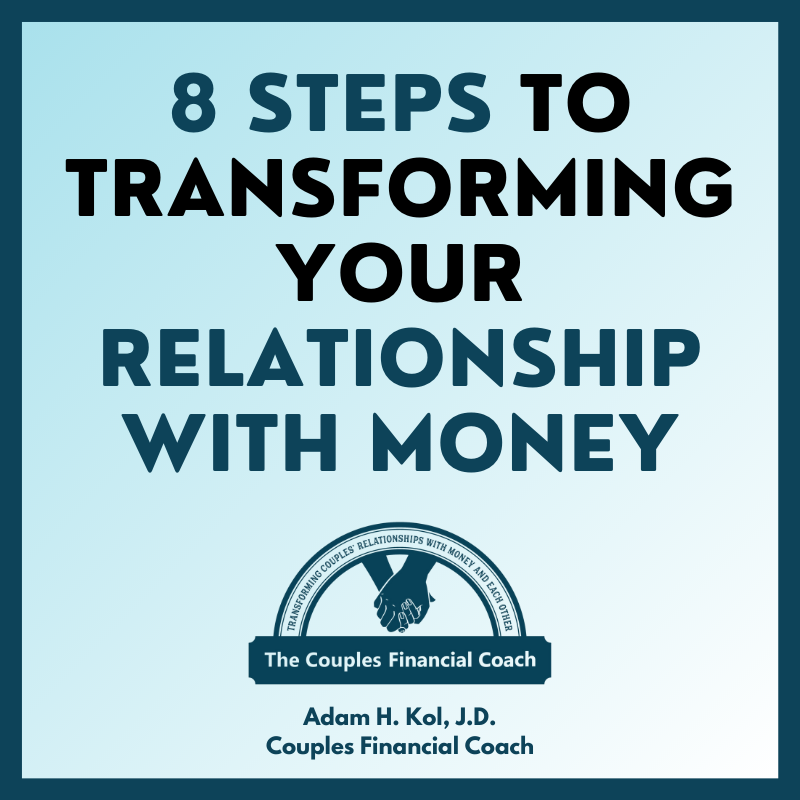

Setting Clear Goals and Objectives

Defining short-term and long-term financial goals together

Sit down with your partner and define both short-term and long-term financial goals. This could include paying off debt, saving for a vacation, or planning for retirement. By setting clear goals together, you create a roadmap for your financial journey and foster a sense of shared purpose.

Creating a shared vision for the future

Discuss and create a shared vision for your future finances. This encompasses your aspirations and dreams, both individually and as a couple. By aligning your visions, you can work towards a common goal, making financial decisions that support your shared vision and bring you closer together.

Establishing measurable objectives

Transform your goals into measurable objectives. Break them down into smaller, achievable steps that you can track and celebrate along the way. Measurable objectives provide a sense of progress and motivation while working towards your shared financial goals.

This image is property of images.squarespace-cdn.com.

Developing a Compromise and Finding Middle Ground

Identifying potential compromises

In any relationship, compromises are necessary when it comes to finances. Identify areas where you can find common ground and be willing to make compromises on certain financial matters. This could mean adjusting spending habits, finding alternative solutions, or reallocating resources to meet both partners’ needs.

Discussing and finding solutions that cater to both partners

Engage in open discussions to find solutions that cater to both partners’ needs and financial habits. Consider brainstorming and exploring creative alternatives that address any differences while honoring each other’s values and priorities. Remember, finding middle ground requires active participation from both partners.

Seeking professional advice if necessary

If you find it challenging to reach a compromise or need guidance on managing your financial differences, don’t hesitate to seek professional advice. Financial advisors or therapists specializing in finances can provide objective insights and strategies to help you navigate through challenging situations and find the best way forward.

Implementing Practical Strategies

Budgeting and tracking expenses

Develop a budget together that aligns with your shared financial goals. Track your expenses to ensure you stay on track and make adjustments as needed. By practicing budgeting and expense tracking as a team, you can both actively participate in managing your finances and work towards your joint objectives.

Creating joint bank accounts or separate allowances

Discuss the possibility of creating joint bank accounts or separate allowances to cater to both partners’ financial habits. Joint accounts can foster transparency and shared responsibility, while separate allowances can provide autonomy and independence. Finding the right balance that works for both of you is essential.

Exploring financial planning tools

Utilize financial planning tools such as budgeting apps, expense trackers, or investment calculators to assist in managing your finances. There are numerous online resources available that can make financial planning and tracking easier and more efficient. Explore these tools together and find ones that align with your goals and preferences.

This image is property of www.choosingtherapy.com.

Supporting Each Other’s Growth and Progress

Providing encouragement and motivation

Support and encourage each other in your financial journey. Celebrate small milestones and achievements to maintain motivation and reinforce positive financial habits. By being each other’s cheerleaders, you create a supportive environment that promotes growth and progress.

Offering assistance and accountability

Offer your assistance to your partner when needed and hold each other accountable to your shared financial goals. This could involve reminding each other of your financial priorities or providing guidance during challenging times. Being there for one another helps solidify your commitment to shared success.

Celebrating milestones and achievements

Celebrate your milestones and achievements together. Whether it’s paying off a substantial amount of debt, reaching significant savings goals, or achieving financial freedom, acknowledge and celebrate your successes as a team. These celebrations reinforce the positive impact of your joint efforts and encourage continued progress.

Seeking Professional Help if Needed

Considering financial therapy or counseling

If you find that financial discussions are consistently challenging or causing strain on your relationship, consider seeking the help of a financial therapist or counselor. These professionals can guide you and your partner through difficult conversations and provide strategies to improve your financial dynamics.

Engaging with a financial advisor

Another option is to engage with a financial advisor. A financial advisor can provide expert guidance tailored to your specific needs and goals. They can assist in developing personalized strategies and help you navigate financial disparities effectively.

Exploring workshops or support groups

Consider participating in financial workshops or joining support groups that focus on couples and finances. These resources offer a wealth of knowledge, shared experiences, and practical tips for managing financial differences within a relationship. Learning from others can provide valuable insights and strengthen your financial partnership.

Approaching your partner about your differences in financial habits requires open communication, empathy, and a shared commitment to finding common ground. By understanding and reflecting on your own financial habits, understanding your partner’s perspective, creating a safe environment for discussions, and setting clear goals together, you can navigate the complexities of financial disparities and build a strong foundation for your financial future as a couple. Remember, seeking professional help when needed can provide additional support to overcome challenges and strengthen your financial bond.